Mankind has sought shelter since the dawn of time. As the human species continue growing in numbers and cultural variety, the fight for this basic need has intensified. Housing serves as an economic, social, and political barometer of a country’s growth and well-being (Austin, Gurran, & Whitehead, 2014). On the economic front, housing investment aids in the reduction of poverty, the creation of jobs, the increase of wages, and the increase of labour productivity. Housing has a significant function in functioning as a valuable asset.

The government’s reduced budgetary allocation for public housing and infrastructure development, urbanization, the high cost of land and building materials, and the limited and high cost of housing finance are just a few aspects contributing to this unprecedented housing shortage. The impacts of these variables and the fast expansion in the urban population of cities have increased the supply/demand mismatch, eventually resulting in high housing costs and rents. This has resulted in affordability issues for urban families. More importantly, the aspect of a low-income level of households has worsened affordability issues. Low-income and young households have less bargaining power thus have a high probability of becoming homeless. To maintain urban stability and long-term growth, the municipal administration must assist low-income families in entering the housing market.

Homeownership Achievement

Housing affordability is the primary concern in cities with considerable and growing housing demands due to an absolute increase in families due to net population expansion and immigration (Yun & Evangelou, 2016). Enhancing household living conditions has been a government strategy for many years, and the US has implemented homeownership programs to improve people’s living conditions. However, ‘living better’ aims for individuals to buy a home and have employment, large salaries, security safeguards, and pension fund assistance. Holupka. & Newman (2012) discovered that both the welfare and labor markets impact house owners after analyzing the US’s present living situation concerning the US’s historical house ownership experiences. However, in many Western nations’ urban centres, the connection between house finance, property prices, and household earnings has varied during the last several decades. Because there is less conveniently available land for development, house finance and home prices have surged.

Whereas informal finance frameworks have had some effectiveness in empowering urban households in developed nations to purchase their own homes, Kallergis et al. (2018) acknowledged that informal finance typically provides slow incremental housing based on retained savings, which is more expensive the end consumer. Owners’ “self-development” through the use of small artisans leads to high real resource costs reflecting inflation, a lack of economies of scale, and a lack of structure (Kallergis et al., 2018). Because of the inadequacies of informal financial institutions, there is a need to find methods to increase the provision of formal credit to low and moderate-income households.

Consequently, rents and housing prices have risen due to increasingly stringent planning restrictions and rising building material costs over time (Aarland & Reid, 2019). Therefore, to solve these issues, many researchers and governors have put a lot of effort into the housing process to obtain a sustainable city housing development course. The affordable housing dilemma in America, for example, is the outcome of rising housing costs, making it unable to supply adequate cheap homes to large households (Baqutaya, Ariffin, & Raji, 2016).). Asserted by (Williams Peter 2017), the local government can develop some preferential tax-policy assistance and financial to ensure stability for the growth of the housing markets. Similarly, the government can construct affordable housing projects in the suburb region where the cost of land is relatively low, making the entry-level housing market lower for low-income households. Through financial aids, the government will create a stable and sustainable development for the housing market and society.

Housing affordability is a major concern in areas where there is an absolute rise in households due to net population growth and immigration (Kallergis et al., 2018). Moreover, absolute and relative increases in low-income renter households, particularly elderly and minority families, and insufficient government programs result in inexpensive housing. According to (Kajuth 2017), addressing affordable housing obstacles lowers development costs by up to 35%, allowing millions of hardworking American families to own or rent a decent property that they could not otherwise afford. Subsidies may be critical tools for lower-income families and people seeking stability and self-sufficiency.

Attaining Affordable housing

Affordable housing can only be realized via the collaborative efforts of the federal, state, and local governments. The National Housing and Habitat Policy of 1997 highlighted that ‘affordable housing is a goal of numerous bodies involved in urban development, including planning agencies, financial institutions, and real estate developers’ (Goetz 2015). It was highlighted that the previous policy to offer public housing was a failure because the government lacked the administrative, financial, and technological competence to achieve this outcome on its own, and the implementation plan was not effectively established after reviewing the situation of housing supply. As specified in the national strategy, it is critical to encourage private and cooperative real estate developers and financial institutions to play an active role in creating affordable housing units while assuring appropriate profits for all parties. This corresponded to the liberalization agenda of government removal from the delivery of goods and services.

Given the severity of the housing problem, the government should adopt a policy aimed at various stakeholders, including the private sector, the industrial sector for labor housing, and the institutional sector for employee housing. According to (Goetz 2015), implementing a strategy that stresses urban planning and promoting a symbiotic growth of rural and urban regions will curb the limitation to housing. Therefore the government must support proven cost-effective technologies and balanced ecological development for sustainable housing initiatives.

Conclusion

Following a review of this body of literature, it is apparent that the country should adopt practical recommendations and regulations for the affordable housing market obtained by comparing and evaluating relevant experiences from other nations and regions. State government efforts are an example of a policy that is highly consistent. This research examines the present state of urban development. It identifies both opportunities and challenges that might assist both the government and potential investors gain a basic grasp of the affordable housing market and its future development prospects.

The research focuses on answering the following questions concerning urban development: Why is it difficult for a young family to get into the real estate market? What are the government’s challenges in developing this market? Why is it critical to construct affordable housing to accomplish a long-term growth goal in the real estate market? What are the government’s alternatives for resolving the debate over affordable housing development? Correlation analysis will be performed between the dependent variable (housing affordability) and the independent variables (which were recognized as significant factors such as the size of the household, interest on the loan, type of mortgage instrument and cost of land) to determine the strength of the association between housing affordability and each of the identified significant factors. The goal is to establish a strong link with affordability.

While there is a lot of literature on housing, there’s not much empirical study on housing affordability, particularly on the factors that influence affordability. As a result, there is a lack of understanding on which elements are crucial in explaining the affordability challenges that urban consumers face in the mortgage housing market in the United States. Previous research on housing in the United States is descriptive, focusing on low-cost housing supply, housing financing and long-term housing delivery. There is empirical research on factors impacting affordability in the international housing literature.

From the above literature review, housing is not only an economic concern but also a social issue. Many governments have yet to achieve their goal of establishing a decent housing policy framework. We learn that affordable housing is a perfect solution to the housing problem that can be achieved by applying various affordable housing development methods in different urban areas.

Hypothesis

Based on the amount of research on house affordability. The first hypothesis is that there is a significant correlation between housing affordability and the size of the household. It is crucial to determine whether the size of the household will affect a family’s ability to afford a house. The second hypothesis is that there is a significant correlation between housing affordability and interest on loans. Interest rates affect expenditure; in this case, it is expected to influence housing expenditure. The third hypothesis is that there is a significant correlation between housing affordability and the cost of land. The cost of land is likely to affect the ultimate cost of housing, and this will either increase or decrease the affordability of housing depending on the cost of the land.

Data

The dataset that has been used in this study is the Housing Affordability Data System (HADS). The Housing Affordability Data System (HADS) is a collection of datasets that measure housing affordability at the unit level, housing unit affordability, and household housing cost burdens, concerning region median incomes, Fair Market Rents, and poverty-level incomes. The goal of these databases is to offer housing analysts reliable, long-term indicators of affordability and burdens. The datasets are based on national files from the American Housing Survey (AHS) from 1985 to 2013 and metropolitan files from 2002 to 2013. The dataset contains N= 64535 households. The tenants were randomly selected within strata based on the housing program, geographic area, and tenant race/ethnicity. The sample was designed to ensure approximately equal representation of the six geographic areas, housing programs, and racial/ethnic categories.

Variables

In this study, the dependent variable (housing affordability) and the independent variables (which were recognized as significant factors such as the size of the household, interest on the loan, and cost of land) to determine the strength of the association between housing affordability and each of the identified significant factors. The dependent variable, housing affordability, is represented by the variable ‘FMR- Fair market rent (average),’ while for the dependent variables; the size of the household is represented by- the variable PER- ‘The variables’ COST06 represents the number of persons in the household, interest on the loan- Housing cost at 6 percent interest, COST08 – ‘Housing cost at 8 percent interest and ‘COST12- Housing cost at 12 percent interest. Cost of land is represented by the variable ‘OTHER COST-which includes land and insurance cost.

Methodology

A Pearson’s correlation analysis will be carried out to determine the nature of the relationships between affordability and the independent variables. The Pearson correlation coefficient measures the direction and strength of a linear relationship between two variables. The Pearson correlation coefficient, r, can take any value between +1 and -1. A value of zero implies that the two variables have no relationship. A positive relationship is shown by a value greater than 0; that is, when the value of one factor increases, so does the value of the other variable (de Winter et al., 2016). A negative relationship is indicated by a value less than zero, that is, as the value of one factor increases, the value of the other variable decreases. An Ordinary Least Squares regression will be used to estimate the relationship between affordability (the dependent variable) and the independent variables (size of the household, interest on the loan, and cost of land).

Cronbach’s alpha test will be used to test the reliability of the data. Cronbach’s alpha is the most often used internal consistency metric. It has been established that a high alpha value provides limited proof of a research instrument’s reliability and that a very high value may even be undesirable when constructing a test of knowledge (Taber, 2017). On the other hand, validity is defined as the degree to which a notion in a quantitative study is reliably quantified. Construct validity will be used to test the measure’s conformance to existing theory and understanding of the concept being measured.

Analysis

Table 1

Table 1 shows the descriptive statistics for the variables under study. There is a wide range in the area median income. The number of observations (N=64535) is relatively large. The analysis is a representation of the housing data for the whole country.

Figure 1

Figure 1 is a histogram that shows the Affordability (Fair Market Rent) In each area. The mean of the data for Affordability (Fair Market Rent) is 1164.40, with a standard deviation of 394.12. It can be observed that Affordability (Fair Market Rent) is not normally distributed, there is some positive skewness in the data.

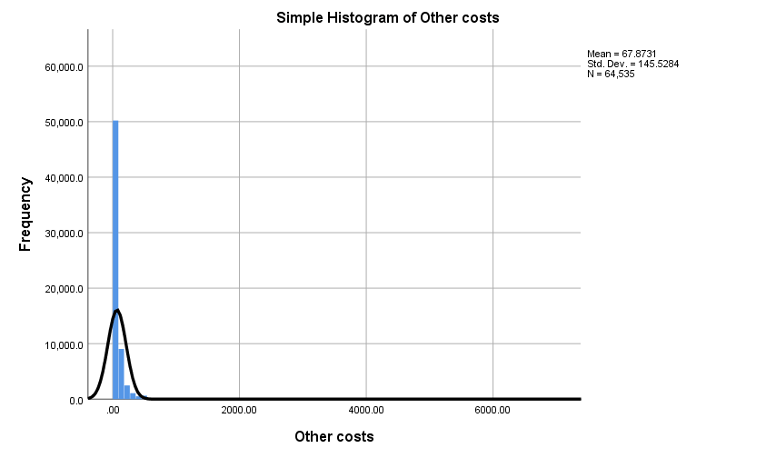

Figure 2

Figure 2 is a histogram that shows the other costs. The mean of the data for other costs(cost of land) is 67.87, with a standard deviation of 145.52. The range of the data for other costs is 6856. It can be observed that ‘other costs’ is not normally distributed, there is some positive skewness in the data.

Figure 3 is a histogram that shows the other costs. The mean of the data for housing cost at 6 percent interest is 1525.58, with a standard deviation of 1671.83. The range of the data for housing cost at 6 percent interest is 6856. It can be observed that housing cost at 6 percent interest is not normally distributed, there is some positive skewness in the data.

Figure 3

Figure 4

Figure 4 is a scatterplot that shows the relationship between the number of persons in the household and the fair market rent. It can be observed that there is a moderately strong positive correlation between the number of persons in the household and the fair market rent. A Pearson correlation was run to determine the relationship between the number of persons in the household and the fair market rent. There was a weak, positive correlation between the number of persons in the household and the fair market rent, which was statistically significant (r = .314, n = 64535, p = .000), as shown in Table 2.

Table 2

The results of the correlation analysis in table 2 imply that as the number of persons in the household increases, so does the fair market rent.

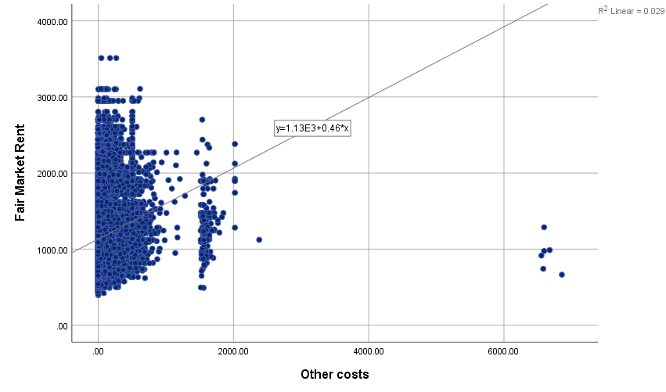

Figure 5

Figure 5 is a scatterplot that shows the relationship between the number of persons in the household and the fair market rent. It can be observed that there is a moderately strong positive correlation between the cost of land (other costs) and the fair market rent.

Table 3

| Table 3: Correlations | |||

| Fair Market Rent | Other costs (Cost of land) | ||

| Fair Market Rent | Pearson Correlation | 1 | .172** |

| Sig. (2-tailed) | .000 | ||

| N | 64535 | 64535 | |

| Other costs | Pearson Correlation | .172** | 1 |

| Sig. (2-tailed) | .000 | ||

| N | 64535 | 64535 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||

A Pearson correlation was run to determine the relationship between the cost of land and the fair market rent. There was a weak, positive correlation between the cost of land and the fair market rent, which was statistically significant (r = .172, n = 64535, p = .000), as shown in Table 3.

A Pearson correlation was run to determine the relationship between the cost at different interest rates and the fair market rent. There was a moderately strong, positive correlation between housing cost at 6 percent interest and the fair market rent(affordability), which was statistically significant (r = .470, n = 64535, p = .000). It was also established that there was a moderately strong, positive correlation between housing cost at 12 percent interest and the fair market rent (affordability), which was statistically significant (r = .465, n = 64535, p = .000). It was also established that there was a moderately strong, positive correlation between housing cost at 8 percent interest and the fair market rent (affordability), which was statistically significant (r = .469, n = 64535, p = .000).

Table 4

Table 4 represents the results of the regression analysis. There is a weak positive relationship between the number of persons in the household and the fair market rent. The p-values for the coefficients of independent variables implying that there is a statistically significant relationship between the number of persons in the household and the fair market rent. Therefore, we reject the null hypothesis and conclude that there is a significant correlation between housing affordability and the size of the household. There is also a statistically significant relationship between the cost of land and the fair market rent. There is also a statistically significant relationship between the housing costs at different rates of interest (6%, 8% and 12%) and the fair market rent.

Table 5

| F (4,60092) =6218.16 | |||||||||

| p-value =0.0000 | |||||||||

| R-square= 0.293 | |||||||||

| Adjusted R-square= 0.293 | |||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Correlations | ||||

| B | Std. Error | Beta | Zero-order | Partial | Part | ||||

| 1 | (Constant) | 836.958 | 3.033 | 275.969 | .000 | ||||

| Number of persons in household | 68.955 | .938 | .255 | 73.507 | .000 | .314 | .287 | .252 | |

| Other costs | -.034 | .010 | -.013 | -3.399 | .001 | .169 | -.014 | -.012 | |

| Housing cost at 12 percent interest | -.086 | .007 | -.566 | -11.567 | .000 | .470 | -.047 | -.040 | |

| Housing cost at 8 percent interest | .204 | .010 | 1.012 | 20.658 | .000 | .475 | .084 | .071 | |

| a. Dependent Variable: Fair Market Rent | |||||||||

Table 5 represents the results of the regression analysis. There is a weak positive relationship between the number of persons in the household and the fair market rent. The p-values for the coefficients of independent variables implying that there is a statistically significant relationship between the number of persons in the household and the fair market rent. We, therefore, reject the null hypothesis and conclude that there is a significant correlation between housing affordability and the size of the household. There is also a statistically significant relationship between the cost of land and the fair market rent. There is also a statistically significant relationship between the housing costs at different rates of interest (6%, 8% and 12%) and the fair market rent. The adjusted r-squared is 0.293, suggesting that 29.3 percent of the total variation in housing affordability is explained by this model. However, 70.7 percent of the variation in the housing affordability is still not explained by the model and requires further specification, this is a major concern. The F-statistic, F (4,60092) =6218.16, p<0.05, suggests that the regression model is a good fit for the data.

Many assumptions were tested in order to test the reliability of the results. The first assumption is that the dependent must have a continuous level of measurement. In this case, housing affordability (Fair Market Rent) meets the criteria. The second assumption is that the independent variables that must have either a categorical or continuous level of measurement, the independent variables used for the regression model meet this criterion. The third assumption is that the data should show some homoscedasticity. The scatterplots suggest that this criterion was met. The fourth assumption is that data used should not show multicollinearity, the Variance Inflation Factors for the number of people in the household and the cost of land (other costs) are less than four, implying that they do not create a multicollinearity problem, on the other hand, costs at 8% and 12% interest rates have very large values of Variance Inflation Factors implying that they are likely to cause multicollinearity problems. Cost at 6% interest rate was excluded from the model because it was highly correlated with the other variables. The fifth assumption is that the residual errors should be approximately normally distributed. The normal P-P plots suggest that the points are not approximately normally distributed. The sixth assumption is that there should be a linear relationship between the dependent variable and each independent variable, the scatter plots reveal that the dependent variable housing affordability (Fair Market Rent) has a linear relationship with each of the independent variables, therefore, this criterion has been met.

Conclusion

Housing affordability is a major challenge in cities experiencing significant and growing housing demand due to net population growth and immigration. For many years, improving household living conditions has been a government policy, and the United States has undertaken homeownership initiatives to do so. ‘Living better,’ on the other hand, aspires for people to buy a home and have jobs with good pay, security, and pension fund aid. While there is a lot of literature on housing, there isn’t much empirical research on housing affordability, especially when it comes to the factors that affect affordability. As a result, there is a dearth of information on which factors are most important in explaining the affordability issues that urban consumers experience in the mortgage housing market in the United States. Previous housing research in the United States has been descriptive, with a focus on low-cost housing supply, housing financing, and long-term housing delivery. In the international housing literature, there is empirical research on factors that influence affordability.

This paper examined the significance of the cost of land, interest rates and the number of persons in the household on housing affordability. The correlation analysis showed an existence of a statistically significant weak, positive correlation between the cost of land and the fair market rent (housing affordability). As the cost of land increases, so does the fair market rent, implying that housing affordability increases as the cost of land increases. The analysis also determined that there was a weak, positive correlation between the number of persons in the household and the fair market rent, which was statistically significant. As the number of people in a household increases, so does the fair market rent, implying that housing affordability increases as the cost of land increases. There exists a moderately strong, positive correlation between housing cost at 6%,8% and 12% percent interest rates and the fair market rent(affordability), which was statistically significant.

It was established that the cost of land, interest rates, and the number of persons in the household significantly affect housing affordability. Policymakers should develop policies that will reduce the interest rates for borrowing associated with housing and find a way of regulating unnecessary hikes in the cost of land. Individuals may make a decision on family planning to check on the sizes of their households to help them have the upper hand in housing affordability.

References

Aarland, K., & Reid, C. K. (2019). Homeownership and residential stability: does tenure make a difference?. International Journal of Housing Policy, 19(2), 165-191.

Austin, P. M., Gurran, N., & Whitehead, C. M. (2014). Planning and affordable housing in Australia, New Zealand, and England: common culture; different mechanisms. Journal of housing and the built environment, 29(3), 455-472.

Baqutaya, S., Ariffin, A. S., & Raji, F. (2016). Affordable housing policy: Issues and challenges among middle-income groups. International Journal of Social Science and Humanity, 6(6), 433.

De Winter, J. C., Gosling, S. D., & Potter, J. (2016). Comparing the Pearson and Spearman correlation coefficients across distributions and sample sizes: A tutorial using simulations and empirical data. Psychological Methods, 21(3), 273–290. https://doi.org/10.1037/met0000079

Goetz, E. G. (2015). From breaking down barriers to breaking up communities: The expanding spatial strategies of fair housing advocacy. Urban Affairs Review, 51(6), 820-842.

Holupka, S., & Newman, S. J. (2012). The effects of homeownership on children’s outcomes: Real effects or self‐selection?. Real Estate Economics, 40(3), 566-602.

Kajuth, F. (2017). Assessing recent house price developments in Germany: an overview. Monetary Policy, Financial Crises, and the Macroeconomy, 225-235.

Kallergis, A., Angel, S., Liu, Y., Blei, A., Sanchez, N., & Lamson-Hall, P. (2018). Housing affordability in a global perspective. Lincoln Institute of Land Policy.

Litman, T., Alex, T., & Litman, E. (2010). Affordable-accessible housing in a dynamic city, why and how to increase affordable housing development inaccessible locations.

Minowitz, P. (2016). Adam smith’s invisible hands. Constitutionalism, Executive Power, and the Spirit of Moderation: Murray P. Dry and the Nexus of Liberal Education and Politics, 241.

Romanova, A. I., Zagidullina, G. M., Afanasyeva, A. N., & Hkairetdinova, R. S. (2015). Experience in the region to increase the availability of housing services. Mediterranean Journal of Social Sciences, 6(4), 549-549.

Taber, K. S. (2017). The Use of Cronbach’s Alpha When Developing and Reporting Research Instruments in Science Education. Research in Science Education, 48(6), 1273–1296. https://doi.org/10.1007/s11165-016-9602-2.

Williams, Peter. “The affordable housing conundrum: shifting policy approaches in Australia.” Town Planning Review 86, no. 6 (2015): 651-677.

Yun, L., & Evangelou, N. (2016). Social benefits of homeownership and stable housing. National Association of Realtors, Research Division

Leave a comment